non filing of income tax return letter format

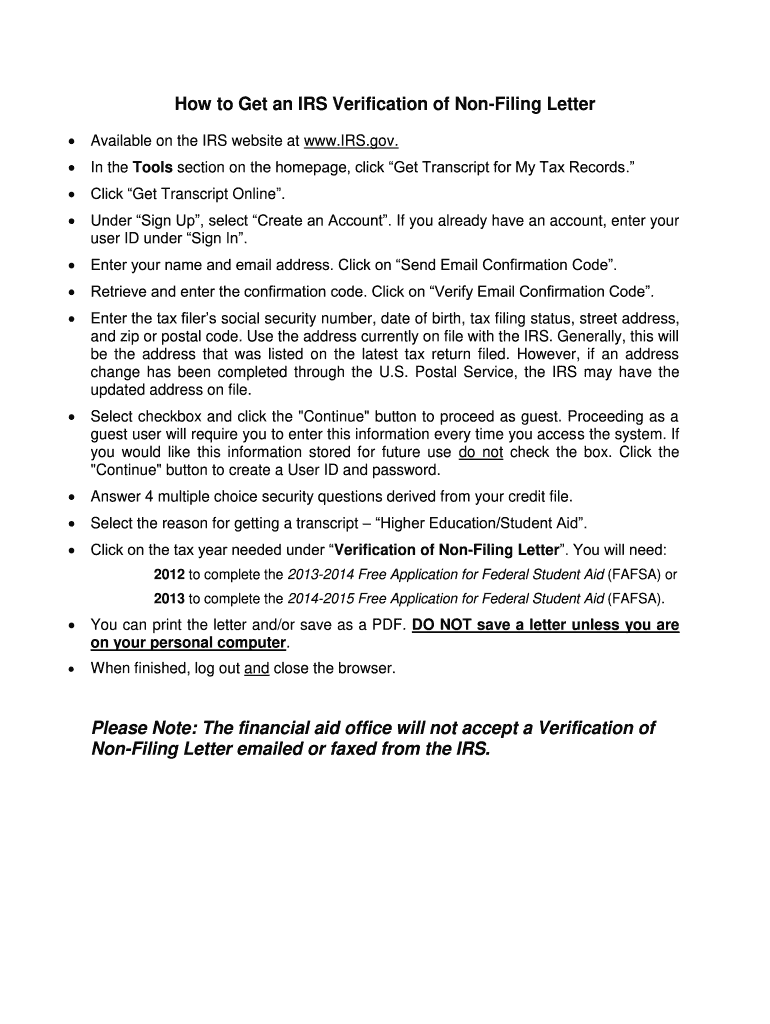

Non-Filing Letter Sample due to not having a SSN ITIN or EIN Date To whom it may concern I full name certify that I did not file a tax return in 20YY. When using Get Transcript by Mail or calling 800-908-9946 the primary taxpayer on the return must make the request.

4 21 1 Monitoring The Irs Program Internal Revenue Service

I am unable to provide.

. How to respond to the notice for Non-filing of Income Tax Return. Sub - Declaration in respect of filing of our Income Tax Return for the past two financial years reg. Upload the document when prompted when submitting Verification.

A copy of IRS Form 4868 Application. Self Employment Tax Return Form 4549 Income Tax Examination Changes Pub. Condonation of delay is applied in case of any delay in filing the income tax return in India.

--Ray B Originally posted by. Sign the IRS Verification of Non-filing Letter. Sample letter of explanation no tax returns for I-864 By babypatz October 27 2009 in Direct Consular Filing DCF General Discussion Posted October 27 2009 1 leonsgal70.

Initial contact with the Non-filer is made using Letter 4149 We Have Not Received Your US. Your statement should be signed and dated and a paragraph or two should explain why you were not required to file income tax returns if no income. On the basis of above you are requested to take on record of the fact of technical error of the Income Tax Portal which disabled the Company to file its return on 30 th.

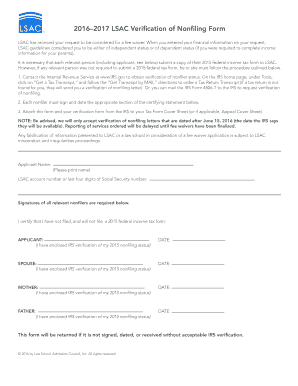

An IRS Verification of Non-filing Letter will provide proof from the IRS that there is no record of a filed tax form 1040 1040A or 1040EZ for the year you have requested. PAN No. Make sure to include the students name and Student ID number on the letter.

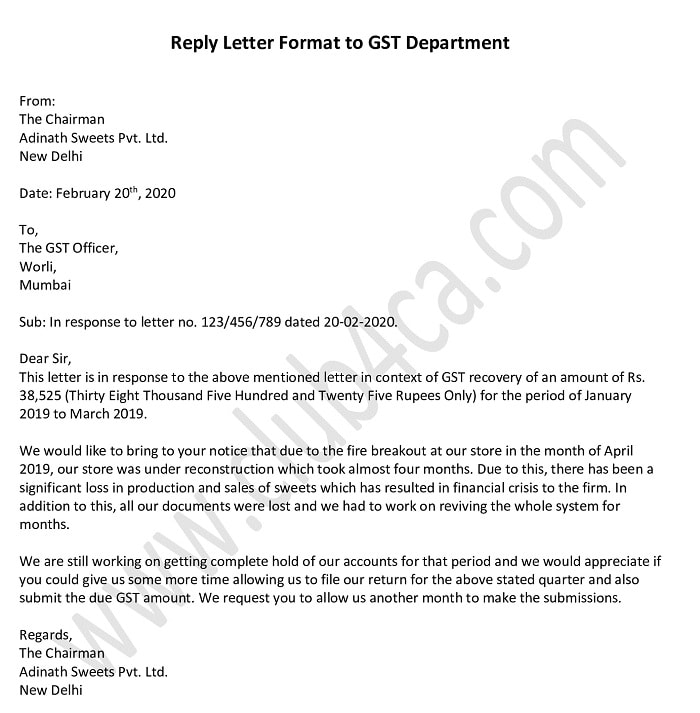

Tax Account Transcript - shows basic data such as filing. If you are in such a situation then writing an application for the same is advised. Response can be either you have filed itr after receiving the notice or itr has not been filed.

EFile your Income tax return online in minutes. MyITreturn ensures accurate efiling of ITR with maximum tax refund. An individual who is required to file an IRS income tax return and has been granted a filing extension by the IRS must provide all the items below.

Draft letter sample for. Late filing or non-filing of Individual Income Tax Returns Form B1BPM The large majority of taxpayers e-file. So kindly give me a format of letter of condonation for delay in filling return.

How Not To Write A Letter To The Irs Requesting Abatement For Form 990 Late Filing Penalties Youtube

Tax Preparation Engagement Letter Form Fill Out Sign Online Dochub

Non Filing Letter Sample Fill And Sign Printable Template Online

Tax Forms Irs Tax Forms Bankrate Com

3 Ways To Write A Letter To The Irs Wikihow

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

3 Ways To Write A Letter To The Irs Wikihow

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

Verification Of Non Filing Letter Fill Online Printable Fillable Blank Pdffiller

Affidavit No Income Tax Return Pdf Notary Public Affidavit

Tax Documents Needed For Marriage Green Card Application

How To Respond To Non Filing Of Income Tax Return Notice

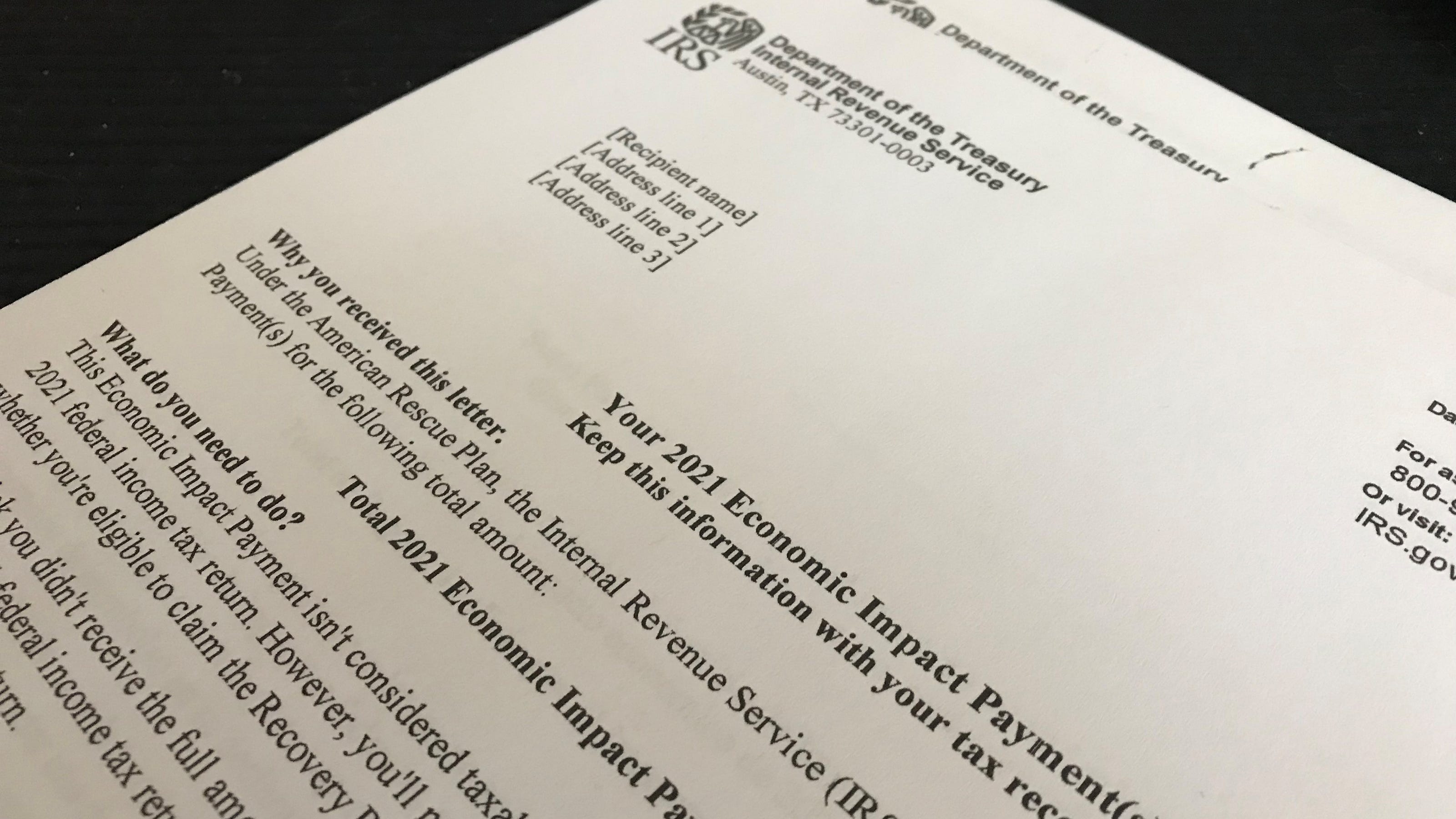

Irs Letter 6475 Could Determine Recovery Rebate Credit Eligibility

Tax Professional Cover Letter Example Kickresume

Reply Letter Format To Gst Department In Word

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template In 2022 Letter Templates Lettering Coloring Pages Inspirational

Respond To A Letter Requesting Additional Information